A CFD involves two trades to speculate on the short term price movement of an underlying asset with the ability to predict it it will go up or down. Whether you make money or lose money still depends on how the market moves, but you avoid the risk of purchasing a true financial product.

In traditional trading, you purchase shares in a company, foreign currency or small amounts of commodities. For better or for worse, you own an actual product, even if only for a short time.

Key Takeaways

- Contracts for Difference (CFDs) are a way to bet on market movements without having to purchase a financial asset

- You can use leverage to increase the size of your positions and profit from falling markets

- If you’re new to online trading, it’s important to do your research when choosing a CFD broker and trading platform

- UK residents will pay capital gains tax on CFD earnings

How Does CFD Trading Work?

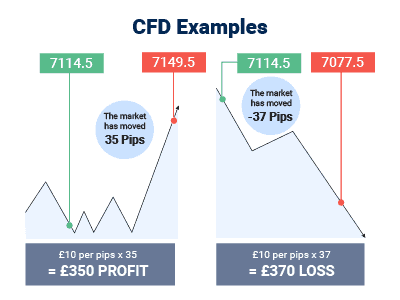

In CFD trading, you make money by correctly predicting whether the price of an asset will rise or fall. Traders usually refer to this as ‘going long’ (buying) when you think the market will rise or ‘going short’ (selling) when you think it will fall.

Unlike traditional trading, you don’t own the actual asset. Instead, you enter into a contract with your broker to pay or be paid the difference in the asset’s price between opening and closing your position. Whether you profit or lose out depends on how much the market moves between opening and closing your position.

Example

Chris believes the price of Phantasy Co will rise in the coming days. Because he doesn’t have a typical brokerage account that gives him access to exchanges, share trading isn’t an option. Instead, he decides to purchase share CFDs through his broker, Saxo Bank.

When Chris purchases the share CFDs, he does so at the same price as if he had purchased actual shares of Phantasy Co. Let’s say that’s £200 per share. He’s not using leverage to enlarge his position – more on that later – so he can afford to 10 share CFDs with the £2,000 in his trading account (£200 x 10 shares = £2,000).

Fortunately, the market moves in Chris’s favour. The market price of Phastasy Co increases to £250 per share, which means the value of Chris’ position likewise increases to £2,500. He decides to close his contract with Saxo Bank and collects a tidy gross profit of £500.

For more examples, you can refer to our comprehensive breakdown of long and short trades.

Can You Trade CFDs With Leverage?

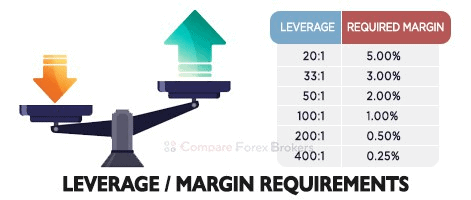

Yes, you can trade CFDs using leverage in most jurisdictions. This means you borrow money from the broker to open a trade. Because your trading account must have enough funds in it to cover the margin requirements to open a trading position, it is sometimes called a margin account.

Margin is expressed as a percentage and represents the minimum balance you’ll need in your account to trade with leverage. Let’s say you want to access leverage of 20:1 to enlarge your £1 position to £20. The required margin is 5%, so you’ll need to ensure that your trading account carries a balance of £1 at all times. The more funds in your trading account, the more leverage you can use.

Leverage is expressed as a ratio such as 1:50. That means that for every £1 you trade, the broker will loan you £50. So, if you have a £10 position and access to 33:1 leverage, you could potentially enlarge your position to £330.

| Instrument Traded | Pepperstone Leverage | IC Markets Leverage | IG Markets Leverage | CMC Markets Leverage | EasyMarkets Leverage | Plus500 Leverage |

|---|---|---|---|---|---|---|

| Forex (Major/Minors) | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 | 30:1/20:1 |

| Major Index CFDs/Minor Index CFDs | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 | 20:1/10:1 |

| Share CFDs | 5:1 | 5:1 | 5:1 | 5:1 | ✘ | 5:1 |

| Commodities/Gold | 10:1/20:1 | 10:1/20:1 | 10:1/20:1 |

10:1/20:1 | 10:1/20:1 | 10:1/20:1 |

| Cyptocurrency | 2:1 | 2:1 | 2:1 | 2:1 | 2:1 | 2:1 |

| Bonds | ✘ | 5:1 | ✘ | ✘ | ✘ | ✘ |

| Futures | ✘ | 5:1 | ✘ | ✘ | ✘ | ✘ |

| ETF | ✘ | ✘ | 5:1 | ✘ | ✘ | 5:1 |

| Treasuries | ✘ | ✘ | ✘ | 5:1 | ✘ | ✘ |

What Are Types of CFDs?

Types of CFDs exist for almost every financial instrument in almost any financial market. Even if it’s not possible for you to trade the asset directly due to regulatory or geographic restrictions.

Below are just a few of the most common types of contracts for difference:

- Commodity CFD – allows traders to speculate on movements in the commodities markets, including energies, metals and agricultural products.

- Index CFD – allows traders to speculate on the price movements of stock indices, like the FTSE 100 or S&P 500.

- Share CFD – a financial instrument that mirrors the price of a company’s stock.

- Forex CFD – allows traders to speculate on the exchange rate movements between two currencies, such as EUR/USD or GBP/JPY.

- Cryptocurrency CFDs – allows traders to speculate on the price fluctuations of cryptocurrencies like Bitcoin or Ethereum.

Why Trade CFDs?

Both beginners and experienced traders can benefit from exploring CFD trading for several reasons.

Similarities to traditional trading

While other derivatives like options, knockouts and futures also allow you to trade without purchasing the underlying asset, they’re more specialised instruments. They may prove too challenging for novice or casual traders.

Because CFDs are designed to mirror the assets they represent, the trading process and market analysis, they may feel more intuitive than other derivatives.

Trade a variety of financial markets

As described above, you can enter into a contract for difference for just about any type of financial instrument. This makes them an ideal tool for portfolio diversification and a great opportunity to explore unfamiliar financial markets.

Retaining your capital

Because you’re betting on financial market movements rather than buying a financial product, you never surrender your capital. It sits in your CFD trading account until you close your position and collect your winnings (or pay out your losses).

If you choose to use leverage to increase the size of your position, you can dedicate a portion of your trading capital to a CFD trade and reap the benefits of a bigger bet while dedicating the remainder of your capital to a hedge.

Profit, even in falling markets

Another benefit of never owning the underlying asset? You have the option to short an asset and profit in a falling market.

Remember Chris from the example above? Let’s say he believes that the price of gold is about to fall. If he traded on a typical exchange, he would need to move on to another commodity, but because he trades CFDs, Chris can short the commodity CFD.

To do this, Chris contracts with Saxo Bank to ‘sell’ at a price of £200 per share and then ‘buy’ when the value falls to £150.

Hedging

Shorting a CFD has benefits beyond profit. It can also function as a powerful form of risk management. If you take a chance-y long position, you can use a complementary short position to protect yourself against losses.

What Are The Costs Of CFD Trading?

CFD trading carries direct costs, like your broker’s spreads and commissions, and indirect administrative fees. It’s important to understand them before you open a position.

The easiest costs to see are those directly connected to your trading. Depending on your CFD provider and trading account, these might include a variable minimum spread plus a commission or a fixed minimum spread alone.

You’ll also need to consider the indirect costs of trading CFDs, such as minimum deposits, withdrawal fees or financing charges for overnight positions. These can sneak up on you if you’re not careful and should play a major role in your selection of a CFD broker. Go beyond the spreads to understand what fees your preferred CFD provider attaches to basic trading operations and administration.

How to Start Trading CFDs?

The shift to trading CFDs may appear straightforward if you’re already trading forex or shares. For those entirely new to trading, the steps below should provide a basic introduction to CFD trading.

1. Identify your CFD trading strategy

As many types of CFDs exist, there are trading strategies. Casual traders and those still learning to trade may want to explore social trading or copy trading. You’ll mimic the positions of experts and professional traders to profit – literally – from their wisdom. If you prefer technical analysis and know how to code, algorithmic trading automated by bots may be more your speed.

Why do you need to understand your trading strategy before choosing a broker? Different CFD brokers offer different combinations of trading platforms and tools, some of which may better support your trading strategy than others.

2. Choose a CFD broker

We always recommend trading through a CFD broker licensed by the appropriate regulator in your jurisdiction. In the UK, that’s the Financial Conduct Authority (FCA).

In addition to trading costs, spend time reviewing the trading platforms and trading tools your broker offers. Some brokers will only allow you to use a particular CFD trading platform with a specific trading account. Others may not support your preferred platform at all or offer an account type with the terms you need

3. Practice with a demo account

Even if you’re an experienced trader, we recommend experimenting with a demo account before transitioning to trading with real funds. Likewise, if you’re working with a new broker, you’ll want to experiment with your platform settings and arrange the ideal trading environment before diving into live trading.

4. Choose a CFD trading account

Once you’ve selected a broker and confirmed the decision with a demo account, you’ll need to decide your trading account type. In general, brokers offer two types of retail investor accounts.

Standard accounts do not charge a commission to execute your trades, but may have a slightly higher minimum spread than you’ll see with other account types. The CFD broker typically also acts as a market maker, which means the broker may take the opposite position on some of your trades to ensure the order fills.

Raw spread and commission accounts often offer tighter spreads but will also charge a commission to execute your trades. The extent to which the broker can narrow the spread depends on its network of liquidity providers, and the best brokers will have access to the same deep pools as banks or other financial institutions.

5. Open your first CFD position

If you’ve followed the steps above, this should feel almost anti-climactic. After all, you practised all of this with your demo account. In your excitement, avoid the risk of overtrading. There’s no need to deposit a large amount of money in your account or to bet your entire balance on your first position.

How To Manage Risk in CFD Trading?

You can manage risk your risk in CFD trading by testing your strategy, hedging your position and using tools like stop-loss orders. It’s important to develop a risk management strategy that accurately reflects your financial situation, experience level and overall tolerance. In addition to hedging, you can also use stop-loss, take-profit and guaranteed stop-loss orders to control your exposure in volatile market conditions.

A Stop Loss Order is a type of trading order designed to limit a trader’s potential losses on a position.

It automatically closes a position when the market price reaches a specified level, allowing traders to manage their risk exposure and protect their investments from significant losses.

If you’re using leverage to enlarge your positions, proceed with caution. Margin trading has enormous potential to increase your profits but can also hand you catastrophic losses if you don’t take steps to protect yourself.

Key Learnings

- CFDs let you speculate on market moves without buying assets.

- CFD trading offers leverage to boost your positions and profit in falling markets.

- Research your CFD broker and trading platform carefully.

- UK residents should be aware that CFD earnings are subject to capital gains tax.

Frequently Asked Questions

What is the best CFD trading platform?

The best CFD trading platform for your needs depends on a number of factors, from your experience level to risk appetite to ideal financial market. If you enjoy social trading and cryptocurrencies, eToro makes great sense. Prefer to play with both forex trading and CFDs? Look for a broker with MetaTrader 4 like Interactive Brokers or CMC Markets.

Spread Betting vs Trading CFDs

Spread betting and CFD trading are similar in that they allow you to speculate on price movements without owning the underlying assets. However, they differ in tax treatment, profit and loss calculation, and the nature of the contracts. Consider your specific financial goals and the regulatory environment in your country when choosing how you’d like to trade online.

Is CFD trading Legal in the UK?

Yes, you can legally trade CFDs in the UK.

Is CFD trading safe?

Yes, CFD trading is safe, provided you do so through a licensed broker. While all online trading activities carry a high degree of risk, you can dramatically reduce the odds of fraud or misuse of your funds by trading with a regulated CFD provider.

With regards to your capital, always practice your trading with a demo account, backtest your strategy against historical data and deploy the risk management tools available to you.

Can I make money trading CFDs?

Yes, you can make money trading CFDs.

Will I pay tax on CFD trading in the UK?

Yes, you will pay capital gains tax on your profits from trading CFDs.